Military Heroes Program

When there is a gap, we step in.

Military Heroes Partnerships

The following initiatives reflect The PenFed Foundation’s current Military Heroes Program partnerships – each addressing critical needs within the veteran community through wellness, creativity, and connection

Team UNBROKEN - Veteran Wellness Initiative

The PenFed Foundation proudly partners with Team UNBROKEN to advance our Veteran Wellness Initiative, supporting the mental and physical well-being of America’s injured, wounded, ill, and aging veterans, as well as their families. Together, we are committed to addressing the visible and invisible challenges veterans face after service through immersive experiences, community connection, and purpose-driven support. This partnership amplifies a shared belief that service-connected injuries do not define potential—and that with the right resources and encouragement, our heroes can continue to thrive.

CreatiVets

We have partnered with CreatiVets to empower our military heroes! CreatiVet’s goal is to offer opportunities for relief and healing for the men and women who have sacrificed so much for our country. Their purpose is to use various forms of art, including songwriting, visual arts, music, and creative writing, to help disabled veterans cope with service-related trauma (i.e., post-traumatic stress, or PTS) by fostering self-expression in a way that allows them to transform their stories of trauma and struggle into an art form that can inspire and motivate continued healing.

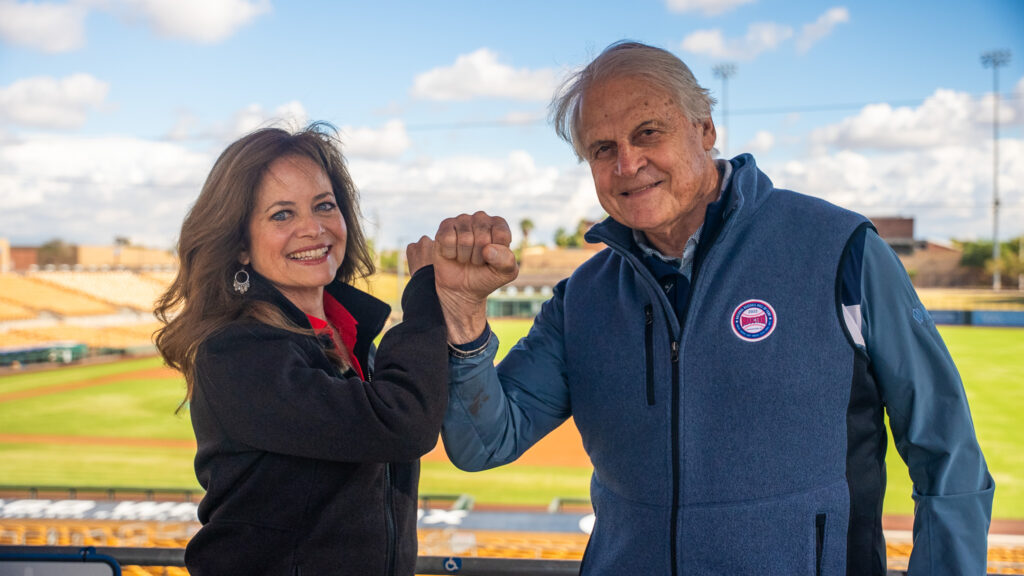

Saving Lives on Both Ends of the Leash

In partnership with Tony La Russa and his family’s La Russa Rescue Champions, this unique initiative transforms shelter dogs into highly trained service animals for veterans. The program simultaneously supports Veteran wellness and animal rescue – saving lives on both ends of the leash while fostering independence, companionship, and purpose for those who have served.